When a merchant that gross in online sales 4.5 billion USD per year, globally, do not understand the importance of having local payments in LATAM, I feel I’m doing my job wrong. This week I changed the settings in the tool I use for prospecting and it paid off. In acquiring I call a “gold nugget” a lead that when you find online, there is no shared connection in LinkedIn, and I came across quite a few this past week.

I messaged a few C-level leads, and successfully got a reply from most of them, explaining my job and what the company I work for does. Luckily, for me, no one had ever approached them offering cross-border payments and I was surprised to learn that they initially did not know the importance of offering local payment methods in LATAM, and this is why I’m here, to put numbers to the countries, and guys trust me, we got money in LATAM, a lot of it.

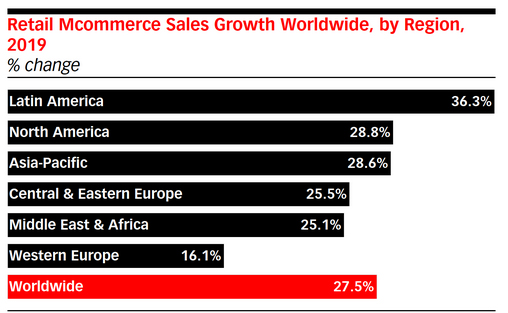

In 2019 155.5 million people in Latin America bought good and services online. Recent figures show that the Latin America e-commerce marked is still rather small, in comparison with the Asia Pacific or North American regions.

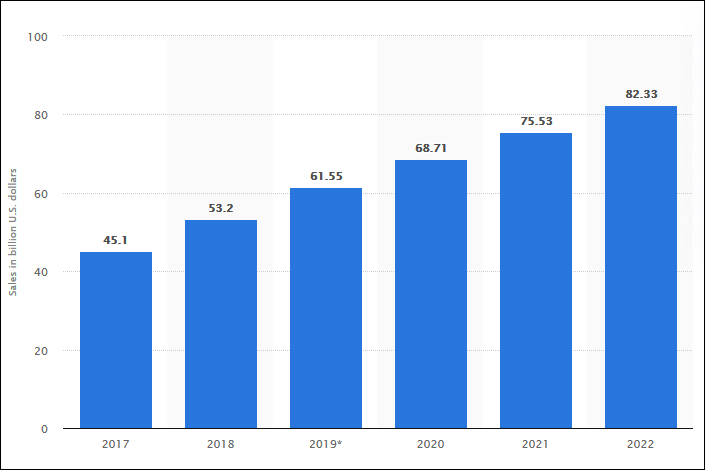

This is the projection in USD of how big Latin America is

Brazil is the region’s largest retail market, accounting for more than one-third (34.0%) of all regional retail sales this year, followed by Mexico (28.9%), Argentina (6.3%) and Chile (6.0%).

Mobile was the primary driver of retail e-commerce sales in Latin America last year. Latin America has one of the fastest-growing smartphone markets worldwide. Inexpensive smartphone options from China have allowed those from lower socioeconomic levels to purchase them and take part in the digital economy. This increase in the number of smartphones users and improved connection speeds favor the growth of m-commerce adoption.

Retailers should focus on consumers becoming comfortable with the security of e-commerce transactions, the growing importance of marketplaces, cross-border e-commerce, the increasing number of e-commerce sales originating outside major cities as well as social commerce.

What is cross-border payment?

Cross-border payment is a term referring to transactions involving individuals, companies, banks or settlement institutions operating in at least two different countries.

The countries involved do not necessarily need to share a border. For instance, a payment from Brazil to China will be regarded as a cross-border payment, even though they are not neighboring countries.

When the two countries involved in the transaction use different currencies, the parties need to carry out a foreign currency exchange to complete the payment.

Multinational companies relying on a global supply chain or with many foreign suppliers might face significant volumes of payments on a daily basis. In order to free the treasury team from the manual workload that would be entailed in processing all those payments manually, some companies integrate payment processing software to automate cross-border payments.

Why is cross-border payments so important in Latin America?

If you want to have a global business, all steps of a cross border transaction need to be identified and sometimes adapted to make sure the customer will have a good experience when making an international purchase online.

In every cross-border payment, banks and a group of varying domestic entities work together to transfer funds. When a purchase is made, a “correspondent bank,” or the entity requesting the money, speaks with the “respondent bank,” which represents the entity buying something.

In simpler words, cross-border payments allow an e-shopper in Mexico to buy from a e-commerce in Amsterdam paying in Mexican pesos while the merchant gets settled in Euros. This means higher approval rates and lower charge-back rates as the transaction now becomes domestic and not international.

This also means your e-commerce can sell to unbanked people. Close to 40% of the adult population in Latin American don’t have bank accounts but still purchase online through Boletos, Balotos, Oxxo and many other cash payments exclusive to each country.

Top 5 products/categories Brazilians buy on international e-commerce websites

- Perfumes, cosmetics and health products

- Clothes and accessories

- Home décor

- Appliances

- Books and subscriptions

Top 5 products/categories Mexicans buy on international e-commerce websites

- Travel

- Events

- Clothing

- Electronics

- Telecom