To understand the future, you have to look at the road we took to get here.

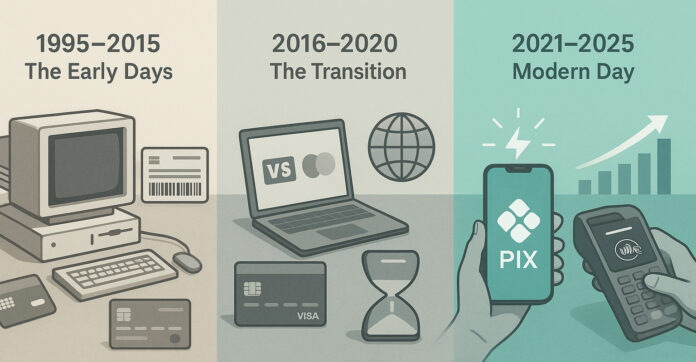

The first online stores in Brazil appeared around 1995. But for a long time, online shopping was a niche.

It wasn’t until 2015, twenty years later, that things started to pick up. By then, only 30% of Brazilians had made at least one online purchase.

Still, that only represented 4.7% of total retail, according to Webshoppers.

Between 2012 and 2015, something interesting happened: Cross-Border shopping took off. The share of Brazilians buying from foreign websites jumped from 33% to 54%.

That period marked the early days of the Merchant of Record model in Brazil. It was rudimentary back then, far from what it has become today, but it was the spark.

From 2013 to 2018, the big worry with e-commerce wasn’t price or delivery. It was trust.

Consumers had no reliable way to check if a store was legit. Disputes, fraud, and chargebacks? A nightmare.

And let’s not forget the tech barrier. By 2019, 34 million adult Brazilians were unbanked. So Cross-Border was only an option for those with international credit cards.

Sure, you had boleto bancário, but it wasn’t exactly smooth. Payment confirmation could take up to 2 business days, and settlement up to a week.

Imagine you’re a merchant who sells a product via boleto on a Friday. You might not get confirmation until Tuesday. Meanwhile, you have to hold inventory for a sale that may never happen.

Then came 2020.

The pandemic changed the game. Online shopping more than doubled, reaching 14% of physical retail. But the conversation shifted.

People no longer asked “is this store trustworthy?” They asked: “when will my package arrive?” That was the turning point for financial inclusion.

Buying from international websites became mainstream. Platforms like Reclame AQUI gained traction and helped boost shopper confidence.

The old trust issues didn’t vanish, but they became manageable.

Now fast forward to 2025.

Digital banks are everywhere. Millions of people who once relied on boleto now use PIX. And PIX is evolving fast: you can already use it for subscriptions, and soon, for installment payments.

For merchants, PIX is nothing short of a blessing. It’s cheaper than credit or debit cards and it settles instantly.

Compare that to boletos that now settled in up to 7 days or credit cards that settle in up to 30. For merchants, PIX is paradise.

What comes next?

Hard to say. But if there’s one thing the last decade taught us, it’s that user experience is king.

Whatever makes checkout faster, easier, and more intuitive that’s what gets adopted.

Because of that, I believe we’ll see an even steeper shift toward hyper-personalized checkout flows.

Visa is catching up with Tap to Pay. Mastercard has rolled out Contactless. And on the horizon? Tokenized payments so seamless that you’ll barely need to enter any data at all.

Less friction means more conversions. And in payments, that’s what it’s all about.